An Unbiased View of Pvm Accounting

An Unbiased View of Pvm Accounting

Blog Article

What Does Pvm Accounting Mean?

Table of ContentsPvm Accounting for Beginners10 Easy Facts About Pvm Accounting ExplainedFascination About Pvm AccountingPvm Accounting - QuestionsNot known Incorrect Statements About Pvm Accounting See This Report on Pvm AccountingThe Main Principles Of Pvm Accounting

In terms of a business's total technique, the CFO is accountable for assisting the business to fulfill economic goals. Some of these methods might involve the company being gotten or purchases moving forward. $133,448 each year or $64.16 per hour. $20m+ in annual earnings Professionals have advancing needs for office managers, controllers, bookkeepers and CFOs.

As a company expands, bookkeepers can free up extra staff for various other organization duties. This can ultimately lead to enhanced oversight, better accuracy, and far better compliance. With even more sources complying with the route of cash, a specialist is a lot more likely to earn money properly and in a timely manner. As a building firm grows, it will certainly demand the help of a full time economic personnel that's managed by a controller or a CFO to handle the company's financial resources.

The 25-Second Trick For Pvm Accounting

While large services might have permanent monetary support teams, small-to-mid-sized services can employ part-time accountants, accountants, or economic consultants as needed. Was this short article practical? 2 out of 2 individuals located this handy You elected. Change your solution. Yes No.

As the building and construction sector continues to thrive, organizations in this market must keep strong monetary administration. Efficient audit methods can make a significant distinction in the success and development of building business. Let's discover 5 important audit techniques tailored especially for the building and construction sector. By executing these methods, building and construction organizations can enhance their financial security, simplify operations, and make educated decisions - construction accounting.

Detailed quotes and budgets are the foundation of building task administration. They aid steer the project in the direction of prompt and rewarding conclusion while protecting the rate of interests of all stakeholders included. The vital inputs for job cost estimate and budget plan are labor, products, devices, and overhead expenditures. This is usually one of the greatest costs in building projects.

The Pvm Accounting Ideas

An accurate estimation of materials required for a task will certainly help ensure the necessary materials are purchased in a timely fashion and in the best quantity. A bad move here can result in waste or delays due to product lack. For the majority of building jobs, devices is needed, whether it is acquired or leased.

Appropriate tools evaluation will assist ensure the ideal equipment is available at the correct time, conserving money and time. Do not neglect to account for overhead costs when estimating task prices. Direct overhead expenditures specify to a task and may consist of momentary services, utilities, secure fencing, and water supplies. Indirect overhead expenditures are day-to-day prices of running your business, such as rent, management wages, utilities, taxes, devaluation, and advertising and marketing.

Another factor that plays right into whether a job achieves success is an exact price quote of when the task will be completed and the relevant timeline. This estimate assists guarantee that a task can be finished within the allocated time and read what he said resources. Without it, a project may lack funds before conclusion, causing prospective work stoppages or abandonment.

The Of Pvm Accounting

Precise task costing can assist you do the following: Recognize the success (or do not have thereof) of each task. As task costing breaks down each input right into a task, you can track success individually.

By identifying these things while the job is being finished, you avoid surprises at the end of the task and can address (and hopefully prevent) them in future projects. A WIP timetable can be completed monthly, quarterly, semi-annually, or annually, and includes job data such as agreement value, costs incurred to day, total estimated expenses, and complete project payments.

The 25-Second Trick For Pvm Accounting

It additionally supplies a clear audit trail, which is essential for financial audits. Clean-up bookkeeping and compliance checks. Budgeting and Forecasting Devices Advanced software offers budgeting and projecting abilities, permitting building and construction firms to plan future tasks a lot more precisely and manage their finances proactively. File Administration Building jobs include a lot of paperwork.

Enhanced Supplier and Subcontractor Monitoring The software can track and handle payments to suppliers and subcontractors, making sure timely settlements and maintaining excellent relationships. Tax Prep Work and Declaring Accountancy software application can help in tax obligation preparation and filing, guaranteeing that all relevant economic tasks are properly reported and taxes are submitted promptly.

What Does Pvm Accounting Mean?

Our client is an expanding advancement and construction firm with head office in Denver, Colorado. With several energetic construction tasks in Colorado, we are searching for an Accountancy Aide to join our group. We are seeking a full time Audit Assistant who will be accountable for supplying practical assistance to the Controller.

Receive and assess day-to-day billings, subcontracts, modification orders, acquisition orders, check requests, and/or other relevant paperwork for completeness and compliance with monetary policies, treatments, budget, and contractual requirements. Accurate handling of accounts payable. Enter billings, approved attracts, order, etc. Update month-to-month evaluation and prepares budget plan trend reports for building tasks.

All about Pvm Accounting

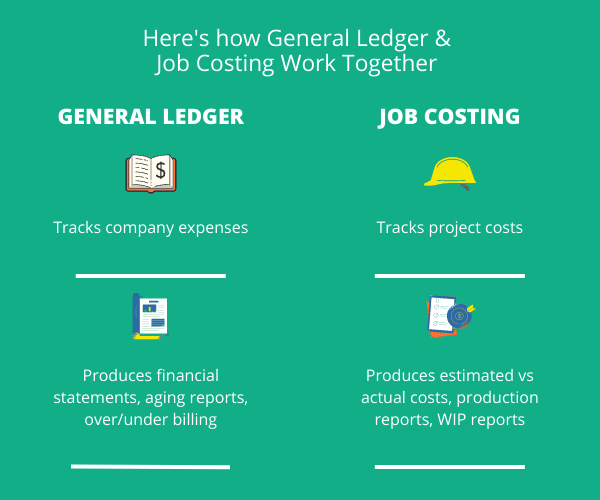

In this guide, we'll explore various facets of building accountancy, its relevance, the requirement tools made use of in this field, and its duty in construction projects - https://issuu.com/pvmaccount1ng. From financial control and price estimating to cash money circulation administration, check out exactly how accounting can profit building projects of all ranges. Construction accountancy refers to the specific system and procedures utilized to track monetary information and make tactical choices for building businesses

Report this page